Car Tax Calculator Texas

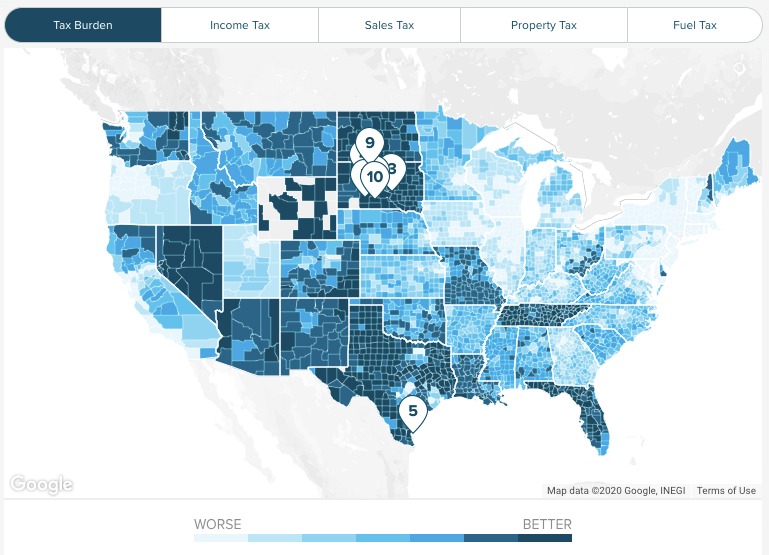

Texas has a 625 statewide sales tax rate but also has 823 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1367 on top of the state tax. Texas taxes on a pack of 20 cigarettes totals 141 which ranks in the middle of the pack on a nationwide basis.

Automobile Purchase Calculator Texas Gulf Bank

Automobile Purchase Calculator Texas Gulf Bank

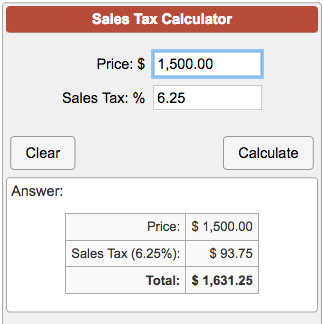

Sales Tax Calculator of Texas for 2021 Calculation of the general sales taxes of Texas State for 2021 Amount before taxes Sales tax rates 625 63 65 675 7 725 75 775 8 8125 825 Amount of taxes Amount after taxes.

Car tax calculator texas. Texas Gulf Bank - Bank with us today. Estimated tax title and fees are 1000 Monthly payment is 405 Term Length is 72 months and APR is 8 Shop Cars By Price Under 10000 Under 15000 Under 20000. The tax is a debt of the purchaser until paid to the dealer.

A vehicles SPV is its worth based on similar sales in the Texas region. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. Liquor on the other hand is taxed at 240 per gallon.

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees.

You can do this on your own or use an online tax calculator. Once you have the tax rate multiply it with the vehicles purchase price. Use this calculator to help you determine your monthly car loan payment or your car purchase price.

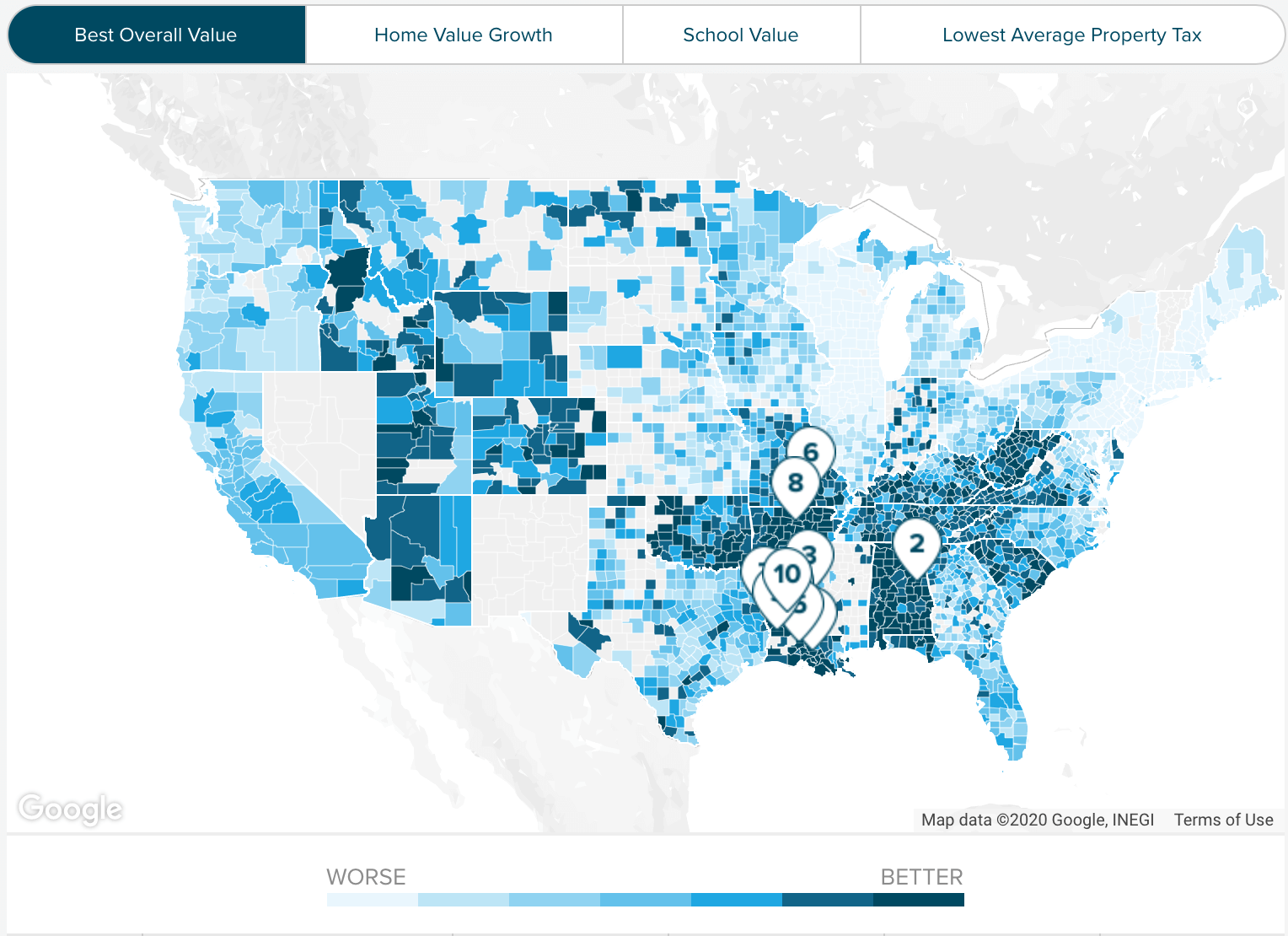

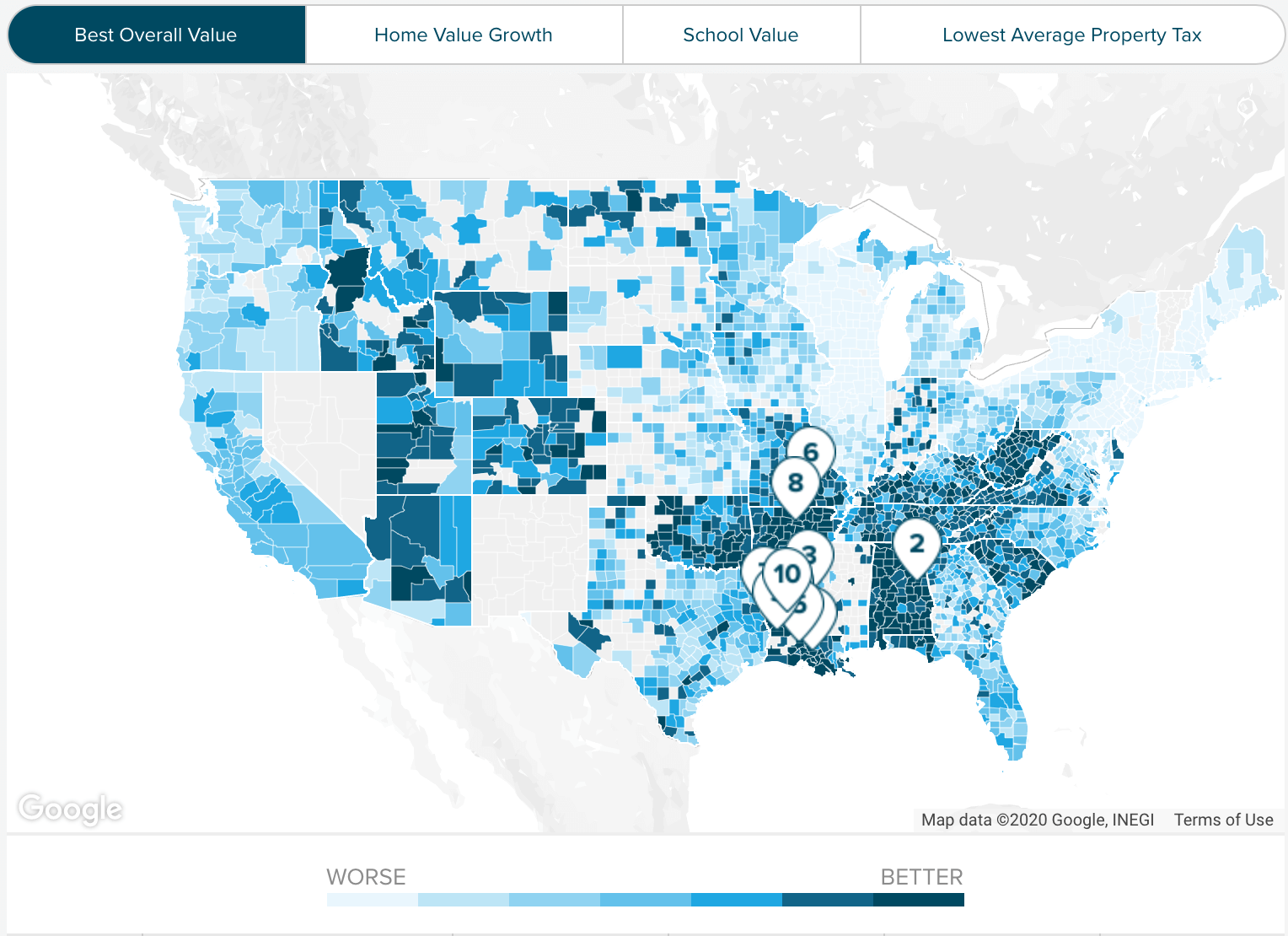

All of these taxes are below average for the US. Monthly Car Payment Calculator Change metrics such as vehicle purchase price or down payment to calculate how much your monthly car payments will be with a loan from Greater Texas Credit Union. Its fairly simple to calculate provided you know your regions sales tax.

Find your state below to determine the total cost of your new car including the car tax. If you are unsure call any local car dealership and ask for the tax rate. Vehicle tax or sales tax is based on the vehicles net purchase price.

Add this to the Dallas MTA tax at01 and the state sales tax of0625 combined together give you a tax rate of0825. 250 for new 1640 for some vehiclescounties. Texas collects a 625 state sales tax rate on the purchase of all vehicles.

Tax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. You can find these fees further down on the page. This is not including the tags and license fees.

The sales tax for cars in Texas is 625 of the final sales price. SPV applies wherever you buy the vehicle in Texas or out of state. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. And if you live in a state with an income tax but you work in Texas youll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. Highway use tax of 3 of vehicle value max.

Keep in mind that this monthly payment is only an estimate. Vehicle use taxMCTD fees NYC and some counties North Carolina. We offer great tools to our customers so they can get in the right car.

Use our loan calculator and find out how much you will pay today. The dealer will remit the tax to the county tax assessor-collector. 2399 Midway Rd Carrollton TX 75006.

Sales Tax According to the Texas Department of Motor Vehicles car owners must pay a motor vehicle tax of 625 percent. 2000 x 5 100. To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625.

Texas Alcohol and Tobacco Taxes. This means that depending on your location within Texas the total tax you pay can be significantly higher than the 625 state sales tax. However the county tax assessor-collector calculates the taxable value on the day of titling and registration.

After you have entered your current information use the graph options to see how different loan terms or down payments can impact your monthly payment. Vehicles sold by Texas governmental entities or the United States A used vehicles SPV is available on the TxDMV website. Regional transportation tax in some counties.

Vehicle Property Tax based on value and locality. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value. You are going to pay 206250 in taxes on this vehicle.

Some dealerships may charge a documentary fee of 125 dollars. The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local countys tax. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or less.

36-67 based on weight. Dealership employees are more in tune to tax rates than most government officials. If you are buying a car for 2500000 multiply by 1 and then multiply by0825.

Hawaii Property Tax Calculator Smartasset

Hawaii Property Tax Calculator Smartasset

Montana Income Tax Calculator Smartasset

Montana Income Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Texas Used Car Sales Tax And Fees

Texas Used Car Sales Tax And Fees

Online Auto Loan Monthly Payment Calculator Spreadsheet Car Loans Car Payment Calculator Car Payment

Online Auto Loan Monthly Payment Calculator Spreadsheet Car Loans Car Payment Calculator Car Payment

Virginia Sales Tax On Cars Everything You Need To Know

Virginia Sales Tax On Cars Everything You Need To Know

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Texas Retirement Tax Friendliness Smartasset

Texas Retirement Tax Friendliness Smartasset

Auto Loan Calculator Associated Credit Union Of Texas

Auto Loan Calculator Associated Credit Union Of Texas

Use W2 As Down Payment Down Payment Good Credit Tax Refund

Use W2 As Down Payment Down Payment Good Credit Tax Refund

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Electric Car Tax Credits What S Available Energysage

Electric Car Tax Credits What S Available Energysage

Do You Pay A Retainer Fee Up Front With A Bankruptcy Lawyer In 2020 Bankruptcy Debt Counseling Filing Bankruptcy

Do You Pay A Retainer Fee Up Front With A Bankruptcy Lawyer In 2020 Bankruptcy Debt Counseling Filing Bankruptcy

Is Your Car Registration Deductible Turbotax Tax Tips Videos

Is Your Car Registration Deductible Turbotax Tax Tips Videos

Texas Car Sales Tax Everything You Need To Know

Texas Car Sales Tax Everything You Need To Know

Belum ada Komentar untuk "Car Tax Calculator Texas"

Posting Komentar